What I Learned This Week (an experiment)

AI Native Product Design, Voice Cloning, and Startup Frameworks

I haven’t written in a while and was inspired by my colleague Becca Lewy who writes to me and a few other people with a weekly roundup of what she learned this week. I’m not sure I’ll do this more than once but I figured I’d give it a try. I’d love your feedback on the good and the bad of this format (and the content…)

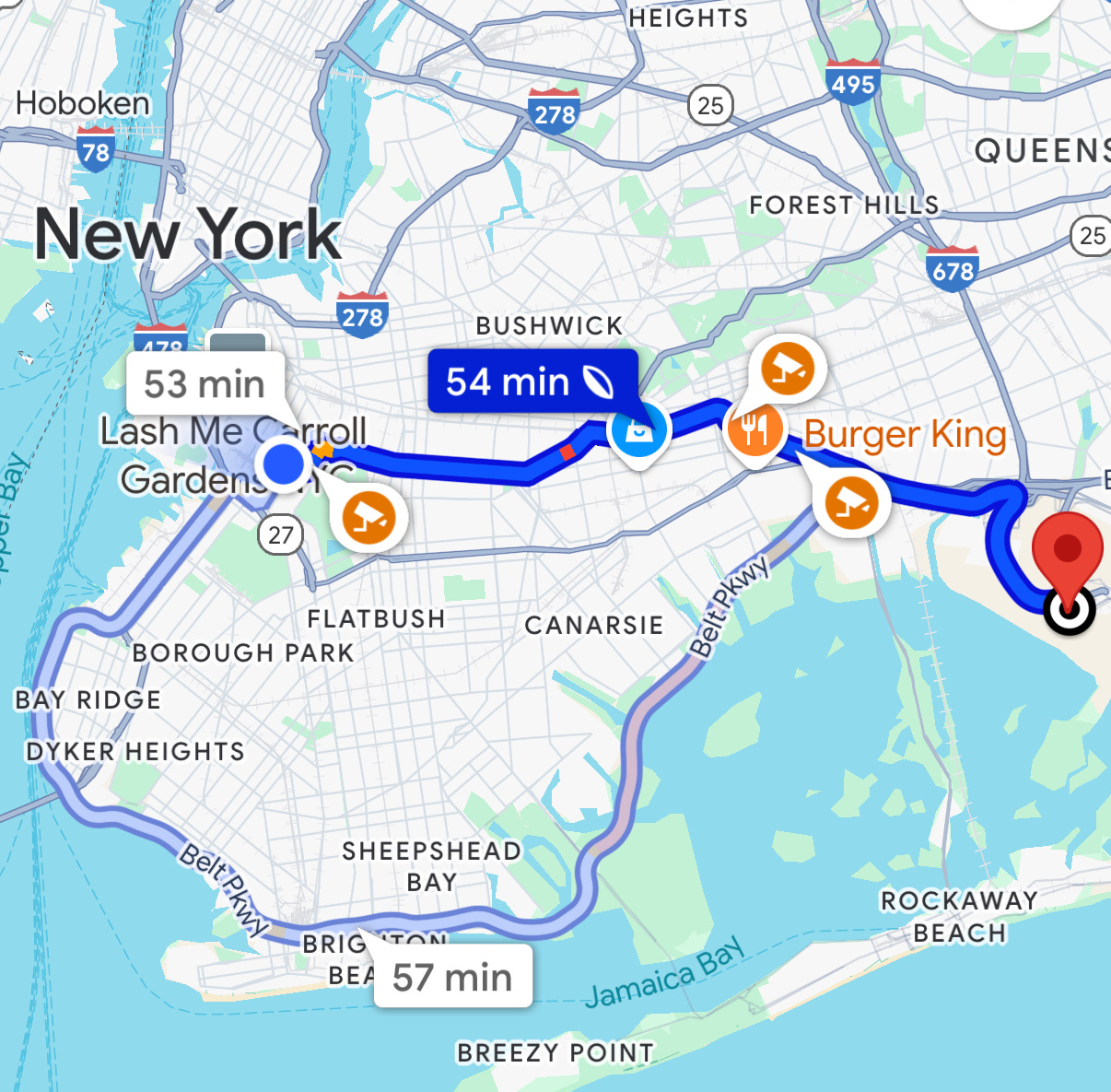

#1 Google maps gives you multiple paths based on the context. We can learn from this for AI-first product design.

Tanzeem Choudhury from Cornell Tech and I were talking about AI-native interfaces. A distinction I usually draw is that you don't necessarily need the AI to do the thing (e.g.,"click buy") for you to be useful. Instead what you want it to do is to act like an amazing chief of staff who can help synthesize choices for you so you make the decision more quickly. I imagine that being the equivalent of making a powerpoint deck to lay out necessary context and presenting possible decisinos. Tanzeem pointed out that we have some products today that do this, and their interfaces are very native to their use cases. Her example was google maps. It has a way to lay out multiple routes, where it's very clear visually which route it recommends, but also helps you understand the context for its choice (traffic, travel times of alternate routes, tolls etc) and lays them out on a map in a way that is digestible so you can quickly decide if there's an alternate route you'd prefer to take.

My guess is that when we see a truly AI native user interface, it will incorporate these principles -- not necessarily telling you this is what you have to do, but communicating extremely efficiently (probably visually) what your options are and with an opinionated point of view on how to evaluate them. Maybe there are other examples today beyond google maps routes.

#2 Voice Cloning is here, it’s cheap, and it is scary good

I was playing around with this Huggingface Space by Steveeeeeeen: https://huggingface.co/spaces/ginigen/VoiceClone-TTS based on Zonos-v0.1, an open-weight text-to-speech model. I was able to take a friend's voice from a podcast episode and with about 20 seconds of clear voice data it made a clone that was according to him “good. very good” and according to a mutual friend “very very good.” While it may still be in the uncanny avlley, my mind went to the implications for phishing. I've already seen docusign phishing scams custom tailored to documents you might be likely to receive to get your bank info. And there are already spam calls. It seems inevitable that people will try to enhance existing social engineering trust hacking tactics using these types of deepfake tools.

#3 Platform Intent Detection

Someone told me they thought X was using AI to process posts to identify whether the posts were promotional in nature or not. No idea if they’re doing this but got me wondering: in a world where the platform can tell if you are trying to market yourself and can charge you more aggressively to promote those posts (and it suppresses if you don’t promote)... what does that mean for what social network content looks like in the future? How might that change the nature of organic promotion?

~ What We’re Talking About ~

Becca (from above) and I recorded all of our internal conversations this week and asked a language model to identify insights that might be worth sharing. We mostly talk about technology and companies but seems like this week we talked a bit about frameworks for startups. Let me know if any are interesting.

Founder Evaluation Frameworks

Wielding Shiny Objects: You discuss how both VCs and founders can get excited about “Shiney Objects” (e.g., AI, NFTs, the “next thing”). Some founders entirely ignore a new trend, others seem to pivot into the next shiny object hoping that having the buzzword in their deck will make the more fundable. The best founders “wield” shiny objects effectively. This means being curuious enough to understand them with enough specificity that they can genuinely asses in what ways the new shiny object is worth spending time on — and, importantly — when to ignore the shiny objects altogether.

One-Shot vs. Iterative Founders: One filter a VC tries to apply is to identify which companies/founders are “one-shot” startups versus “iterative” founders. When we use Replit coding agents, we notice that it generates a “pretty good” first version but the “AI Slop Code” gets worse as you try to iterate on it, whereas using Cursor, it can’t generate the first version in one-shot but it is great at giving you control over iterating over an existing product. We want to invest in founders who — conceptually — are Replit in terms of their idea generation, but can git-pull and become Cursor to iterate.

Technology as a Problem to fall in love with: Some investors say not to fall in love with the technology, fall in love with the problem. Dennis Crowley (founder of Foursquare) is in love with the problem of how people navigate and understand the world around them. This is a philosophical problem but just as worthy as falling in love with a market problem in my mind. In his case, my sense is that technology is a tool to wield in service of inventing new interfaces to solve this “problem.” But falling in love with a technology can be ok too: the Huggingface team was in love with what’s possible with language models (as was I when we became the very first investor) and that was their north star, whether it was building an AI friend to chat with or open-sourcing the code they wrote to translate the Transformers paper into Python code.

Asymptotes of Iteration: What the founder is passionate about will probably show up in the product. A food blogger will build Foursquare into a restaurant media business. Being obsessed with how people navigate the world makes it more likely to build Foursquare into a more horizontal data platform. The problem a founder is in love with will reveal itself one way or another as they iterate towards what they are meant to build. I want to think of some examples of startups that really pivoted into a very commercial use case (wondering if in those cases the founder was in love with a market, or if someone else stepped in to run the business, or if the founders grow to fall in love with a different problem).

Identifying Non-Obvious Founders: You discuss the challenge of identifying promising founders who don't fit the "central casting" profile that typically attracts VC attention (e.g., ex-Meta Product Manager), it's an advantage for a smaller fund that has partner-level bandwidth to spend time with these high potential founders. Generalist funds are probably most prone to investing in central casting whereas specialists and thesis-driven firms are able to evaluate the specific team’s approach regardless of “pedigree.”

Strategy

Money doesn’t buy Product-Market-Fit (mostly): You articulate a nuanced view on capital deployment: "I don't believe that you can buy product market fit... however, a potential counter-example is that if you believe someone is an amazing researcher who can attract amazing people... money could help that person lure top talent away from their jobs."

Bowling Pin Strategy Applied to Acquiring Customers: In the 2010s when Giphy was launching its API the first (or so) user was GroupMe. At the time they were a “hot startup” but were still a very small team that was taking product risks. Once GroupMe was using the Giphy API it gave them the ability to go both up and down market — small startups wanted to be like GroupMe so incorporated it, then progressively bigger companies want to innovate like the medium sized ones — Tinder, Twitter, and eventually Apple (in iMessage), all adopted it too. Chris Dixon wrote about this applying it to building marketplaces but I think the same thing applies to acquiring customers (e.g., API integrations).

This concludes my experimental What I Learned This Week post. Let me know what you think!

Matt

@matthartman